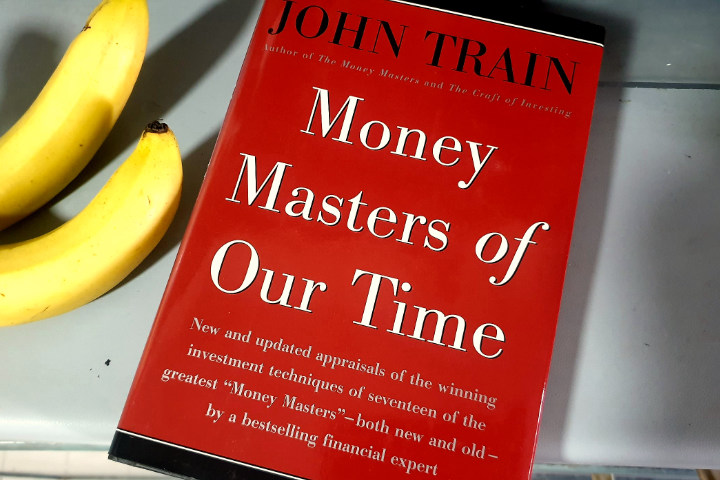

Stories of successful investors, revealing their strategies, decisions, and mindset. It highlights their different approaches to wealth-building, offering valuable lessons on risk, patience, and financial insight.

In the intricate world of finance, where fortunes are made and lost with the flick of a market ticker, John Train’s “Money Masters of Our Time” emerges as an enlightening expedition through the minds of the titans who have shaped financial landscapes.

He nonchalantly embarks on a journey to explore the minds and methods of some of the most influential financial figures of the late 20th century.

The book is both a captivating exploration of wealth creation and a close-up of the personalities that have shaped the financial world.

Some of the most successful investors of our era. This literary journey is akin to a guided tour through a museum of financial art, where each masterpiece tells a story of risk, reward, and relentless pursuit.

The author is adept at storytelling and has analytical prowess. Which is displayed in his ability to delve deep into the lives of these figures allows him to present a story that is both informative and absorbing. But beyond simply recounting their triumphs and failures, he intertwines a rich narrative about the pursuit of wealth and the psychology behind it.

I was immediately drawn to Train’s delicate balance between celebrating these “money masters” and his underlying critique of their single-minded pursuit of power and fortune. It’s as if he is whispering that while their success is awe-inspiring, there may also be something inherently flawed in their obsession with accumulation.

It distills complex financial concepts into narratives that are both engaging and accessible. The book profiles a diverse array of investment luminaries, each with their unique approaches and insights into the art of wealth generation. What sets this book apart is how it paints a holistic picture of what it truly means to master money.

From the first page, it becomes clear that this is no dry financial text. It reads more like a thrilling biographical collection where the central characters, world-renowned figures like Warren Buffet, George Soros, and Michael Milken, are elevated to the status of modern-day titans.

These individuals represent a fascinating array of backgrounds, philosophies, and strategies for wealth.

Buffett, for instance, a name synonymous with investment acumen, embodies the humble, conservative investor who believes in buying businesses, not stocks. Buffett’s affinity for value investing is unquestioned. And it is revealed how this seemingly simple strategy requires an astute understanding of both businesses and human nature. The narrative unfolds like a symphony, where each note reflects Buffett’s disciplined patience and unwavering focus on long-term growth.

Buffett never invested in ‘hare-brained’ schemes. He preferred to bet on tortoises with staying power.

On the other end of the spectrum, Soros is the risk-taking, market-savvy financier who capitalizes on the unpredictability of the global economy. His approach to investing is as dynamic as the markets themselves. Soros’s focus on reflexivity, a concept that posits that market realities are often shaped by investors’ perceptions, offers a refreshing perspective on the interplay between psychology and finance. The depiction of Soros is both respectful and insightful, capturing the essence of a man who navigates financial markets with the precision of a seasoned chess player anticipating his opponent’s every move.

What makes this book so compelling is that it doesn’t just give us the “what” of their strategies but the “why”. Like why Buffett believes in a slow, steady climb, and why Soros thrives on volatility.

Train’s knack for humanizing his subjects is particularly evident when he brings their personal lives into the narrative.

We aren’t simply reading about their financial strategies but also the personal philosophies and life experiences that shaped their approaches.

This gives the book a certain depth, moving beyond a mere financial playbook and into the realm of human behavior and decision-making.

It is clear that the financial prowess of these figures is not the product of sheer chance. Rather, it’s an intricate dance of intelligence, instinct, and (let’s be honest) sometimes an immense amount of ego.

Take, for example, the story of Mark Lightbrown. Where it’s not so much as to what stocks to buy. But all about techniques. It dives into the story of his rise.

However, what makes this work truly stand out is the larger theme weaving through each of these stories. The notion of “financial alchemy”.

This idea that wealth is not just about accumulating money, but about transforming an idea into something worth millions forms the backbone of the book.

Throughout the narrative, it examines how these financiers have taken seemingly mundane concepts like arbitrage, debt structuring, market speculation, and turned them into art forms.

The idea of financial alchemy suggests that these individuals have an almost magical ability to turn base financial concepts into gold.

Yet, it also paints a picture of a world where this “magic” often leaves destruction in its wake.

A good pun here would be that these individuals have managed to bank on their ideas, though sometimes, it’s the public that pays for it.

This theme of financial wizardry is especially prominent in the way it critiques the broader financial system.

For all their brilliance, these “masters” often operate within systems that are in need of reform. Train is clear-eyed about the disparity between the wealth they amass and the social consequences of their actions.

The description of the rise of hedge funds and leveraged buyouts, while informative, often serves as a critique of the speculative world these individuals helped create. A world that can feel divorced from the realities of everyday people.

While the book highlights the success of these figures, it also subtly asks whether such success should be the ultimate goal for society.

The irony, of course, is that while these financiers may possess extraordinary abilities, many of their decisions have negative repercussions, creating a deeper divide between the haves and have-nots.

Train also does not shy away from highlighting the occasional missteps and challenges faced by these money maestros.

It is in these moments that the book reveals its greatest strength. An acknowledgment that even the most brilliant minds are fallible. This candid portrayal adds depth to the narrative, reminding readers that success in investing, much like in life, is often accompanied by setbacks and lessons learned along the way.

Shortcomings

As much as the book is rich in its exploration of these larger economic and ethical themes, there are moments where the book’s presentation feels like it gets a bit too cozy with the titans of finance.

The praise is often lavish, almost to the point of hero-worship.

At times, the author seems too enamored with the intelligence of his subjects and doesn’t engage deeply enough with the more controversial aspects of their wealth-building methods.

Perhaps what’s missing is an honest exploration of how these individuals often skirted the line between genius and excess.

This is not to say the book is shallow. Far from it.

However, it would have been refreshing to see an interrogation of the broader implications of wealth and power more directly.

A more thorough exploration of how these investment strategies influence global markets and affect everyday lives could enhance the book’s relevance for readers seeking to understand not only how fortunes are made but also how they shape our world.

Another interesting thing Train doesn’t fully explore is the changing landscape of finance in the 21st century.

Given how many of his “money masters” were integral to shaping modern financial markets, there is little mention of how their methods have evolved or how they might apply in the upcoming digital age when the book was first published.

I wonder how these titans would go about what they do today where cryptocurrencies, algorithmic trading, and AI-driven strategies are emerging.

A bit more forward-thinking would’ve given the reader a glimpse of how the financial world, though still dominated by these figures in some ways, is undergoing a transformation.

Biggest Takeaway

The idea that wealth is not merely the result of opportunity but of strategy, vision, and, often, ruthlessness.

It is an intricate dance of risk and reward, where the most successful are those who have the foresight to read the signs and the nerve to act boldly.

The final message seems to be that in a world where everyone is chasing after financial success, it is not always the smartest who win, but those who know when to take the greatest risks.

At some point as you read through the book, you’d come to the realization that while there is no one-size-fits-all approach to investing, certain principles such as discipline, patience, and a willingness to learn are universal keys to success.

Financial knowledge is indeed wealth. And perhaps even more valuable than gold itself. So next time you’re about to invest, remember. It’s not just about having money. It’s also about having a sense of cents!

Ultimately, the book offers a fascinating glimpse into the lives of financial legends, but it also raises important questions about the cost of such ambition.

If there is one criticism I would levy, it is that the book occasionally glosses over the ethical and societal implications of the financial strategies discussed.

Wealth, after all, is not just a personal achievement. It’s a force that ripples across society.

In a world where the gulf between the rich and poor continues to grow, the book stands as a powerful reminder that, even in the world of finance, one must always ask: “At what cost?”